Earlier this week, various MLB sites, including

HardballTalk, posted this quote by Kenny Williams, GM of the Chicago White Sox,

"“For the game’s health as a whole, when we’re talking about 30 million dollar players, I think it’s asinine,” Williams said in an interview with Comcast SportsNet. “We have gotten to the point of no return. Something has to happen. And if it means the game being shut down for the sake of bringing sanity to it, to franchises that aren’t going to stop the insanity, I’m all for it.”

For a little context, Williams was asked whether the White Sox would pursue Albert Pujols when he becomes a free-agent at the end of the season. I read the piece, yawned, then thought to myself, "is it that asinine?" Then I thought to myself, "how many times can I use the word asinine in one post?" Then I did a little research...maybe $30M is asinine, but it's not THAT asinine.

Let me start by saying, there's no easy way to do this. You might be able to find salary records for someone like Lou Gehrig, Babe Ruth, etc., but you can't find payroll records for the rest of the team to put a given salary in context. Full payroll records are a pretty recent invention, going back to the mid-'80s or so. Anyway, given that we're talking about Albert Pujols here, universally recognized as one of the best players in baseball at this time, I decided to examine the cases of a couple of other ball players who received new contracts at or near the height of their respective careers. I take their cases, in the context of their team payroll and try to answer the question, "is $30M an asinine amount of money to pay a truly great player in today's baseball economy?"

First, a definition:

Asinine [as-uh-nahyn], adj. : "foolish, unintelligent, or silly; stupid"

So we're talking about a "foolish or stupid" amount of money here. That's pretty much a judgment call, ask the fans in St. Louis whether $30M a year is a "foolish or stupid" amount of money to spend on Pujols, most of them will probably say no. Ask the Pittsburgh Pirates and they'll tell you that's almost their entire payroll (currently $34.7M for 2011). I digress.

First up:

Ken Griffey Jr. - signed 9-year, $116.5M ($12.95M per) contract with Cincinnati Reds

You look at the yearly dollar figure on this one and it kinda puts today's contracts in perspective, namely because $12.95M a year doesn't sound like much at all...and that was only 11 years ago folks. Anyway, the context here is that Griffey had just completed one of the greatest 10-year stretches of offensive AND defensive performances in Major League history. In the 10 seasons prior to 2000, Griffey hit 382 HRs, drove in 1,091 runs, scored 1,002 runs, stole over 150 bases, won 10 Gold-Glove awards in CF, went to 10 All-Star games and won the MVP award once. At 29-years old, he was one heck of a HOT COMMODITY and the Mariners probably knew they couldn't afford to re-sign him again, so they traded him and then let the Reds pony up.

Adding up the team salary from the

2000 Cincinnati Reds page on Baseball-Reference, we get a number right around $46,500,000 and adding in data that isn't available, we can probably assume a payroll of about $50M. Griffey Jr. was paid $9,329,700 that year which is about 18.66% of the overall payroll. In 2001, the team payroll is reported at around $48,775,000, which again we can probably safely assume was actually about $50M. Griffey Jr. was paid $12,500,000 that year which calculates to about 25% of the overall payroll.

Putting it another way, I measured Griffey Jr.'s salary compared to the next highest player on those teams. In 2000, the next highest salary belonged to Dante Bichette...I'll pause while you laugh...at $7M. Griffey's salary was 133.2% of that. In 2001, the next highest paid player was Barry Larkin at $9M, Griffey's salary was 138.8% higher than that. To summarize, between 2000 and 2001, which were the first two years of Griffey's new contract, his contract averaged 21.8% of the payroll and was, on average, 136% of what the next highest paid player on the team was making.

In the midst of research, I found an unforeseen good example:

Albert Belle - signed 5-year, $55M ($11M per) with the Chicago White Sox

In 1996, Belle finished off a very nice 6-year stretch with the Cleveland Indians which saw him hit 234HRs, drive in 711 runs, finish in the top-7 for MVP voting 4 times, make the All-Star team 4 times and lead the AL in RBIs 3 times. In the 1996 season he was a free-agent, and at 29-years-old, a pretty valuable one at that. He was a PR nightmare, but no one could knock his on-field skills. The Chicago White Sox decided to make him the highest paid player in the game, offering him a 5-year, $55M contract (worth $75M in today's cash, thanks Wikipedia).

In 1997, the White Sox payroll was a healthy $57,579,500. Belle's salary that year was $10M, good for 17.3% of the pie. In 1998, the team payroll was a shade below $40,000,000 making Belle's $10,000,000 worth about 25% of the pie. At that point, the two split ways due to a nifty clause in Belle's contract that allowed him to demand that the White Sox make him the highest paid player in baseball again. The Sox declined to do so which made him a free-agent immediately. The Orioles picked him up and wah-lah, Belle was once again the highest paid player in the league, signing a 5-year, $65M deal.

In comparing Belle to his White Sox teammates, it shakes out similarly to Griffey Jr. and his Reds teammates. In 1997, the next highest paid player on the White Sox was none other than Frank Thomas who made $7.125M, Belle's salary was 140% of that number. In 1998, Thomas was once again the 2nd highest on the team at $7M, with Belle making 143% of that at $10M.

Next Up:

Derek Jeter - signed a 10-year, $189M contract with the New York Yankees

Prior to the 2001 season, Jeter signed this contract with the Yankees and you would be hard-pressed to find anyone who would say he didn't deserve every cent of it. The Yankees had made the playoffs 6 years in a row at that point, they'd won 4 out of 5 World Series including 3 straight in 1998, 1999, and 2000, and Jeter was cementing his new status as "Yankee Captain." Jeter wasn't the same as Griffey Jr. or Belle in terms of his on-field production, but he was equally as valuable, playing a key middle-infield position and playing catalyst in a dangerous Yankee lineup.

In 2001, the Yankee payroll was

$112,287,143 and Jeter's salary that 1st year of the contract was $12.6M, making his portion worth about 11.2% of the total pie. In 2002, his salary jumped to $14.6M, but the team payroll also jumped to $125M+ which held his portion steady at 11.5%. Jeter doesn't fit my examples quite as well because the Yankee payroll really started blowing everyone else out of the water in the early-2000s and skewed the numbers a bit.

In comparison to his teammates, Jeter was still top dog (until A-Rod came along). In 2001, the next highest paid player on the team was long-time Yankee Bernie Williams at $12.357M, making Jeter's salary the biggest by only 2%. In 2002, however, Williams was again the 2nd highest paid Yankee, but his salary remained the same while Jeter's bumped up to $14.6M, making Jeter's salary 118% of Williams'.

Alex Rodriguez - signed a 10-year, $252M deal with the Texas Rangers

In the same year that Jeter signed his big deal with the Yankees, A-Rod signed what was then the richest contract in sports history with this mega-deal. In 2001, A-Rod was a hot commodity, more because he was clearly going to be great AND he was only 24 years old. He'd hit 40+ HRs three years in a row and showed that rare combination of power, speed and consistency.

In 2001, was the Ranger payroll was

$87,213,000 and A-Rod's cut was $22M meaning that the Rangers were giving A-Rod 25.2% of their overall payroll. In 2002, the Rangers bumped the payroll to $105,726,122 and A-Rod's salary remained the same at $22M lowering A-Rod's portion to 20.8%. Interestingly enough, according to FanGraphs, A-Rod actually out-performed his contract in 2002, they calculate his 9.8 WAR that year to have been worth $25.4M.

It's barely worth mentioning, but since I've done if for the other players, I'll do it for A-Rod. In 2001, the 2nd highest paid player on the Ranger ballclub was Rafael Palmeiro at $9M (A-Rod salary was 244% of that). In 2002, a somewhat forgotten character named Juan Gonzalez took 2nd place honors, making $11M to A-Rod's $22M (200%).

Just as a side-note here, I saw that FanGraphs starts tracking player salary vs. their WAR value in 2002. In looking at A-Rod, since 2002 he has been paid $230.4M and he's been worth about $220M on the field. That's not a bad ratio considering how monstrous his last two contracts have been.

---------------------------

I could keep going here,

Troy Tulowitzki,

Joe Mauer,

Cliff Lee,

CC Sabathia, etc...there have been so many players in the past few years who've signed huge deals. What I wanted to highlight is two things...a) big-time deals given to a single superstar player have been worth anywhere from 11% (Derek Jeter) to 25% (Belle, A-Rod, Griffey Jr.) of the total team payroll and b) those individual players have generally been paid at a level that is significantly higher than anyone else on the their respective teams.

For a comparison with my earlier examples, at $30M per, Pujols would be the highest paid players on the Cardinal roster by $13M, with the next highest being

Matt Holliday at $17M. $30M is 176% of $17M, which is A-Rod territory in terms of salary supremacy, but Pujols is A-Rod type talent...or better. If the Cardinals gave Pujols that kind of money, their payroll would likely have to inflate to about $125-130M to accommodate him, which puts his piece of the pie at 23-24%...not unreasonable given the other examples I've shown.

Former TBS writer SR (who now writes for

RiverAveBlues, check him out) pointed me to

this article, written by Dave Cameron over at FanGraphs in which Pujols' value is compared to two (or 3) other players whose WAR adds up to Pujols average WAR (that was convoluted and I apologize). In the piece, Cameron argues that a +6 WAR player, like Pujols, could be considered more valuable than 2 +3 WAR players because +6 WAR players are both harder to obtain and also free up roster space for easier to obtain +2-3 WAR players. The opposite argument could be made that if the +6 WAR player is injured, all of his value is removed whereas you don't lose quite as much if one of the +3 WAR players is injured...but I digress because I'm starting to get confused myself. The bottomline in Cameron's piece is that, in baseball, the prevailing thought is that wins are linear in terms of their value, and that many MLB teams view it that way precisely because of the risk vs. reward model. Many teams see an advantage in having two pretty good players vs. one superstar because in the first instance, it's not an all-or-nothing bet. Getting back to Pujols, the Cardinals could mitigate some of their risk by loading the front-end of a long-term deal with Pujols (much like the Yankees did with A-Rod) and having it taper off towards the end when Pujols value is likely to decline because of age.

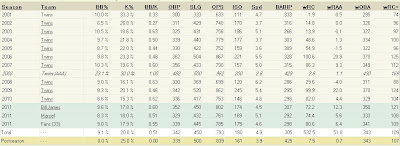

Generally speaking, I would agree with Kenny Williams that a $30M salary for one player is 'asinine,' but not for Pujols. He is the best, or one of the top 3 best, players in the game right now, period. He has consistently performed at an elite level, he has maintained his health over that time and, well, he's one of only a small handful of players who is legitimately worth $30M/yr. In fact, going back to that same handy chart I referred to in my discussion of A-Rod's 2001 contract, Pujols has been paid ~$75.6M since 2002, and has been worth $267.7M on the field in terms of WAR...which comes out to about $29.75M per year...pretty darn close to $30M/yr.